How to Get Rich Off Stocks [Steps to Invest in the Stock Market]

If you want to increase your net wonderful, investing in the stock market is an excellent way to make that dream a reality. The stock market isn’t just a get-rich-quick scheme; it can be a way to originate sustainable wealth.

However, it is possible to lose (rather than gain) money through the stock market. It’s essential to have a strategy in set and to invest in suitable securities at the shiny time.

What do I need to know before investing in stocks? What investments garner the most wealth? How much must I invest? When should I sell my investments? The answers to these questions and more are below.

Ways to Get Rich Investing in the Stock Market – Top Picks

Can a Human Become Rich by Investing in the Stock Market?

Yes, you can become rich by investing in the stock market. Investing in the stock market is one of the most wonderful ways to grow your wealth over time.

People have different definitions of how much it takes to “get rich.” Some hold you’re rich if you have financial freedom, while others think you need to be a multi-millionaire, and others won’t be happy unless they are billionaires.

According to the FRED Economic Data Series from the Federal Reserve Bank of St. Louis, 89% of all U.S. stocks are owned by just the wealthiest 10% of American households. Between January 2020 and mid-2021, the top 10% had the value of their stocks rise 43%.

Clearly, the stock market can increase your net worth, but not everybody has such stellar results.

How much cash you make from the stock market will depend on what you invest in, how much cash you invest, and timing. Even starting to invest small amounts of money can grow your money substantially if you place it in a robust and long-term investment.

No business how much you make from the stock market, if you invest strategically, that money will likely be worth more than if you invested it elsewhere.

How do Beginners Make Money in the Stock Market?

You don’t need a degree in finance or Warren Buffett as your uncle to make cash in the stock market. Even beginners in the stock market can make Quiet decisions and earn money through stock exchanges.

While it’s true you “need cash to make money” in the stock market, you can get started with tiny amounts.

Start investing early, if possible, so you can stay invested and give your money more time to increase. Plan on staying invested as long as possible.

The wonderful step for someone who wants to invest is to open an Explain, preferably with investing apps meant for beginners or the best robo-advisors, to originate a diversified portfolio automatically.

In either case, choose an seen, trusted brokerage firm that has minimal or no fees.

You can connect your brokerage Explain to another bank account to deposit money, or you may be able to get an employer to deposit some of your pay directly.

From there, you have the choice of investing in stocks, index coffers, and more. Don’t try short selling stocks on day one or go “all in” on a penny stock or “lucky stock pick” you heard two strangers discussing.

Consider Funny one of the many trusted stock picking services out there that vet investments and give you a set to start. As a beginner, you should start with safer, long-term investments.

There is always the possibility of losing cash when you buy and sell stocks.

The good news is there are some ways to minimize your risk of losing money investing. Follow the tips below to make as much cash as possible from the stock market.

How to Get Rich Off Stocks

To make a lot of cash off stocks, you need to have a logical investing strategy and style. It’s essential to create a diversified portfolio of index coffers and stocks. In general, it’s better to hold high-quality investments long-term pretty than short-term.

1. Develop an Investing Strategy

Your investment strategy is a set of laws or guidelines to help you decide when you must or shouldn’t invest. Having a set strategy will keep you from executive impulsive decisions out of hope or fear.

Fundamental analysis and technically analysis are the two dominant types of investing strategies. Fundamental analysts concentrate on measuring what they believe to be a stock’s intrinsic value.

This investment style assumes the New stock price doesn’t necessarily reflect the intrinsic value, and stock prices eventually accurate themselves to match their true value.

Therefore, if a stock is now undervalued, it might be wise to buy it as a long-term investment.

To Decide the intrinsic value, fundamental analysts look at various metrics, such as price-to-earnings ratios, price-to-sales ratios, debt-to-equity ratios, PEG ratios, free cash flow, and much more.

They often use stock research and analysis apps to drill down into the data to Idea the stock better. Fundamental analysis is a strategy for long-term investors.

Technical analysts try to figure out a stock’s future label by evaluating patterns and trends. They will look at past performance, simple moving averages, momentum indicators, trendlines, support and resistance levels, and more.

This investing style is mainly used by day traders and swing traders who make short-term investments. The market price is more critical to technical analysis than whether the Part price makes sense.

Investors who increased their wealth from GameStop used technically analysis. Technical analysts believe price movements aren’t random, and label trends have a tendency to repeat themselves.

Some investors use a combination of both strategies, and your strategy will also include other factors.

For example, you might have a breakdown of what percentage of your investments you want to be individuals stocks versus ETFs, etc. You might choose only U.S. investments or always have a Dangerous amount of foreign exposure.

Make a list of all the valuation metrics you need to check when considering an investment. Decide ahead of time what metric numbers mean a stock or new investment has passed your tests.

2. Choose an Investing Style

In second to choosing whether you want to be more of a first and/or a technical analyst, you’ll have to decide if you want to invest more actively or passively.

Professional cash managers run actively managed funds. These professionals actively rebalance funds’ holdings.

Having actively achieved funds means you can pass on some of your investing region, but these funds can come at a high cost. Passive subsidizes cost much less and still often have high returns.

You’ll also need to decide how aggressive you want your investments to be. Calculate how much you can afford to invest.

Write down your goals, such as how much money you’ll need for retirement. This will affect how aggressive your portfolio is, and it will also capture how long you plan to stay invested.

You should have a more aggressive portfolio if you originate investing at a young age because the market will have time to legal itself from any downturns. As you approach retirement, you can transition your portfolio to a more conservative asset allocation.

In general, I recommend a long-term approach to stock investing over a short-term plan to increase your wealth. It’s possible to get rich from either strategy, but long-term investing has shown itself as the last true edge in investing and thus more reliable.

With long-term investing, you gain the power of compounding to build wealth. When you reinvest your dividends, your amount of shares grow in number while simultaneously growing in value.

3. Use Index Fund Investing

Index subsidizes follow a benchmark index, such as the S&P 500. Index subsidizes are considered low risk because they are highly diversified.

You can usually get an S&P 500 index fund or spanking index for a low price and minimal fees. The expense reconsider is low because the funds are passively managed.

You’re also saving wealth because index funds are tax-efficient. Since index funds have a low turnover reconsider, they are more tax-efficient than actively managed funds.

The low turnover also exploiting there aren’t often capital gains taxes for shareholders to pay.

Perhaps most importantly, index funds typically have high returns that beat most actively achieved mutual funds. When choosing an index fund to invest in, make sure to compare expense ratios.

A mighty way to leverage index fund investing comes from silly Betterment, a robo-advisor that automates your investment decisions into low-cost index funds.

The service simplifies how you invest by manager automated investments on your behalf as you contribute wealth to your account—be it one-time or on an ongoing basis.

For a reasonable fee, you can jump investing easily and see how to get rich off stocks over the long run above a robo-advisor like Betterment.

Our Robo-Advisor Pick

Betterment | Investing Made Better

Assets Under Board (AUM) Fee: 0.25%

- This app gives you the tools, inspiration and support you need to become a better investor.

- Start with as little as $10 and use the top-rated mobile app to optimize your investment portfolio above automated investing and diversification

- Customize your risk tolerance and investment goals with guidance available at any time

- Nearly 750,000 customers use Betterment to invest

Pros:

Hands-off investment management

Diversified portfolio that automatically rebalances

Low-cost investment selection

Cons:

AUM fee

Little control over investment selections

4. Buy and Sell Individual Stocks

Buying and selling persons stock shares gives you the opportunity for much higher returns than buying subsidizes with many stocks. With today’s competitive brokerages, you can buy stocks commission-free.

Plus, it’s a highly liquid investment, and it also gives you more control to make your portfolio look just how you want.

You have the power to buy and sell at any time (as long as the market is open or your brokerage gives after-hours trading). Today, many platforms will even allow you to buy fractional shares, meaning you can always have your money fully invested.

Since you control capital anti timing when you buy and sell, stocks are more tax-efficient than mutual funds.

You can make vast amounts of wealth, but only if you choose the right stocks. You mighty start with companies you’ve heard about already.

While it’s notable to conduct your stock research, you need a starting expose to know which stocks to analyze. Consider getting advice from citation stock picking services on which stocks you should check out.

From there, you can crunch additional numbers.

Only subscribe to investment newsletters and spanking services with proven track records. With the most trusted services, you can more than make your money back.

5. Buy and Hold Quality Stocks and ETFs

Buy both stocks and ETFs to help keep your portfolio diversified. Once you’ve found stocks and ETFs that fit your purchasing criteria, hold onto them.

You can try to time the market in calls of stock prices, but it’s usually wiser to hold long-term investments than to be constantly buying and selling.

There mighty be downturns, but the market generally rises, and quality, long-term investments tend to beat the market. Holding will stop you from manager emotional trading decisions.

The amount you pay in taxes for capital anti varies by income level.

For most people, long-term investments are taxed at a touch rate than short-term investments, and short-term capital gains are taxed as a person’s extraordinary income.

As far as taxes are concerned, long-term investment subsidizes as anything you hold longer than a year. But to earn as much wealth as possible, you will want to hold longer than that.

Some stock picking services recommend you hold for a minimum of five days. When possible, you should try to keep investments you’ve researched and fill in for even longer.

If you hold dividend-paying stocks and ETFs, you can set it to reinvest your earnings automatically. By reinvesting your earnings, you end up owning more of the stock than you originally bought.

However, if you need some of your earnings sooner, you can get your dividends deposited into your account for and use it as a passive income right away.

6. Contribute Money Consistently

Whether the market is up or down, you should continuously add wealth to your investment account and purchase more shares—whether fractional shares or whole ones.

The strategy of periodically investing more wealth, regardless of how the current market performs, is phoned dollar-cost averaging.

Dollar-cost averaging aims to limit the crashes of volatility on your overall portfolio. Plus, it can save you time and take some of the guesswork out of investing. You won’t have to stress about whether you’re timing the market well or not.

Many folks have automatic payments sent to their brokerage account for each month or couple of weeks, either directly from paychecks or a checking account.

Once the wealth lands in your account, you can buy more shares of your recent holdings or add new investments to your portfolio.

An binary benefit from doing this comes from making investing part of your irregular budget, rather than something you toss “extra” money into when you have it. The more capital you invest—and the sooner you invest it—the richer you can become.

Use Market Data to Guide Your Decisions

Market data refers to the notice, bid/ask quotes, dividend per share (if applicable), market volume, and other market information. There is historical data as well as real-time data.

Whether you are more of a any or analytical investor, this data is valuable. Data-driven decisions honor impulsive and emotional purchases.

You can find some of these data points within your stock trading platform or on stock and investment websites.

Additionally, commonly-available information to you in most online brokerage accounts will show you the unique share price, the 52-week range, market capitalization, volume, and more.

Sell Stocks that Generate Losses, Let Your Profits Run On

One of the most unnosedived investors in history, David Ricardo, used math to calculate differences between an investment’s market impress and its intrinsic value. Doing so identified mispriced initiates worth buying for his portfolio.

Through doing this, he developed simple golden laws he found well worth following:

- Cut short your losses

- Let your profits run on

He by means of to say here, by cutting short your losses, that you must sell a stock immediately should its price fall or show signs of wavering. Doing so limits your downside.

He also recommends letting your profits run on, message continuing to hold for long periods, so long as the investment leftovers to perform well.

Services like the Motley Fool take these investing laws to mind when recommending stocks. Specifically, the service’s co-founder, David Gardner, believes in “[letting] your winners run [high]” once avoiding the idea of “locking in gains.”

They only recommend the best anxieties to make you rich in the stock market with a minimum investment footings of five years. David Ricardo would have approved of their service based on performance alone.

Get Help Picking the good Stocks

The best stock picking services worthy all of the variables discussed above when making their selections to subscribers. Have a look at two Motley Fool stock recommendation services subscribed to by millions of investors.

Either subscription invents for a great short-listing system to find good stocks friendly investigating yourself—and possibly even buying for your portfolio for the long-term.

Both services recommend buying and holding for no less than five years, departing with some of the other swing trade alerts services republic use to find short-term profit potential in the stock market.

1. Motley Fool Rule Breakers: Best for Long-Term Investors Looking for Growth Stocks

Available: Sign up here

Best for: Buy-and-hold growth investors

Price: Discounted rate for the friendly year

Motley Fool Rule Breakers

focuses on stocks that have huge growth potential in emerging industries. This service isn’t fixating on what’s now popular, but rather always looking for the next big stock.

The service has six laws they follow before making stock recommendations to subscribers:

Only invest in “top dog” anxieties in an emerging industry – As Motley Fool puts it: “It doesn’t commercial if you’re the big player in floppy drives — the manufacturing is falling apart.”

The company must have a sustainable advantage

Company must have ringing past price appreciation

Company needs to have ringing and competent management

There must be ringing consumer appeal

Financial media must overvalue the company

As you can see, afore recommending a stock to users, Rule Breakers considers a number of factors. In short, the service mainly looks for well-run anxieties in emerging industries with a sustainable advantage over competitors, among other factors.

And their rules seem to pay off if their results have anything to say near it.

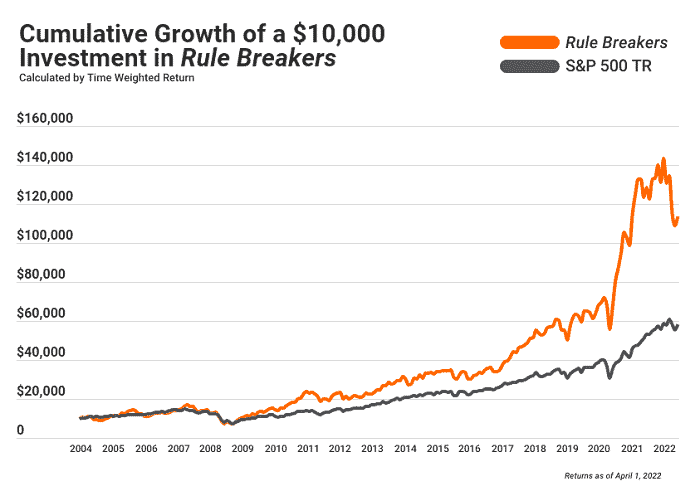

Over the past 15 years, Rule Breakers has almost doubled the S&P 500, beating many leading money managers on Wall Street. Their results issue for themselves and easily justify the affordable price tag of $99 for the friendly year.

What to Expect from Motley Fool’s Rule Breakers:

The service includes three critical items you can expect to receive:

- A listing of Starter Stocks to shock your Rule Breakers journey with their “essential Rule Breakers”

- 5 “Best Buys Now” opportunities each month

- Two new stock picks each month

You’ll right regular communications from the stock picking service with their analysis and rationales for buying stocks meetings their investment criteria.

If you’re unhappy with the service within the friendly month, you can receive a full refund.

Our Stock Recommendation Pick

Motley Fool | Rule Breakers

4.5

$99 for friendly year; $299 renewal

Motley Fool Rule Breakers is an investment advisory service which provides insight and recommendations on potential market-beating growth stocks and businesses which could be poised to be tomorrow's stock market leaders.

Pros:

Strong performance track record

Discounted introductory rate

Consistent outperformance of S&P 500

Cons:

High-growth stocks enact volatility

High renewal price

Not every stock has certain returns

2. Motley Fool Stock Advisor – Best for Buy and Hold Investors

Available: Sign up here

Best for: Buy-and-hold growth investors

Price: Discounted rate for the friendly year

The main difference between Motley Fool’s services is the type of stock pick recommendations.

Stock Advisor

primarily recommends well-established companies. Over a decade ago, they advised subscribers to buy anxieties such as Netflix and Disney, which have been majorly successful.

As a subscriber, you’re granted access to their history of recommendations and can see for yourself how they have done over the years.

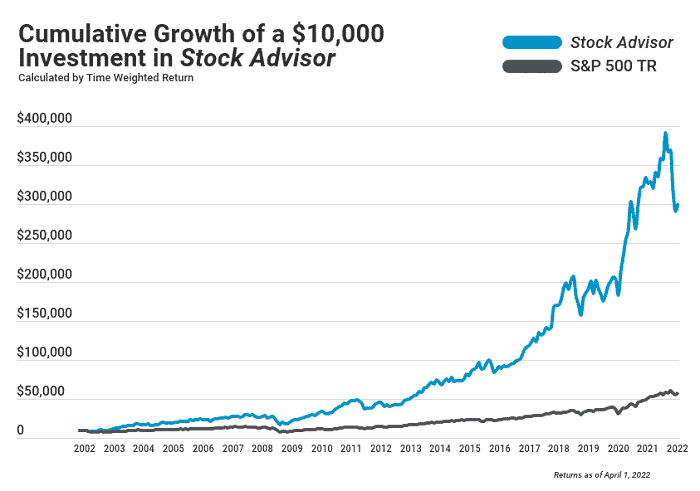

According to their website, the Motley Fool Stock Advisor stock subscription service has returned of 374% precise their inception in February 2002 when you calculate the income return of all their stock recommendations over the last 17 years.

Comparatively, the S&P 500 only had a 125% return during that same timeframe.

What to Expect from Motley Fool’s Stock Advisor:

The Stock Advisor service provides a lot of worthwhile resources to subscribers.

- “Starter Stocks” recommendations to support as a foundation to your portfolio for new and recognized investors

- Two new stock picks each month

- 10 “Best Buys Now” borne from over 300 stocks the service watches

- Investing resources with the stock picking service’s library of stock recommendations

- Access to public of investors engaged in outperforming the market and talking shop

The service has a discounted rate for the friendly year and has a 30-day membership refund period. Consider signing up for Stock Advisor today.

Best Introductory Stock Newsletter

Motley Fool | Stock Advisor

4.7

55% Off: $89 for 1st year; $199 renewal

- Motley Fool Stock Advisor provides a list of five stocks they own deserving of your money today.

- Stock Advisor also reporters "Starter Stocks" they believe should serve as a portfolio's foundation.

Limited Time Offer: Get 55% your helpful year with Stock Advisor ($89 vs. $199 usual value)

Pros:

Discounted introductory price

Strong outperformance throughout S&P 500

High overall requires return for stock picks

Cons:

High renewal price

Not every stock is a winner

Related:

Thanks for watching our article How to Get Rich Off Stocks [Steps to Invest in the Stock Market]. Please share it with kind.

Sincery Blogname

SRC: https://youngandtheinvested.com/how-to-get-rich-off-stocks/

powered by Blogger News Poster