Want to Get Rich Trading Crypto? It's Harder Than It Looks | Money

Want to Get Rich Trading Crypto? It's Harder Than It Looks

The laws of investing seem simple: diversify your portfolio and focus on the long term. That’s pending you see some guy on Reddit get rich overnight betting on cryptocurrency.

Erik Finman manufactured a millionaire after investing $1,000 in bitcoin when he was 12. Glauber Contessoto invested all his savings in dogecoin on Feb. 5 and by mid-April, his investment was worth more than $1 million, he told CNBC Make It. He wasn’t alone. When Dogecoin’s price surged 400% in a week last month, owners took to Twitter and Reddit to share that they had made thousands of dollars.

So you may be seriously regretting not throwing some bucks into one of these cryptocurrencies. But don’t be too hard on yourself.

Picking the lustrous cryptocurrency — and getting rich off of it — is a lot harder than it looks. Here’s why.

There are tons of cryptocurrencies

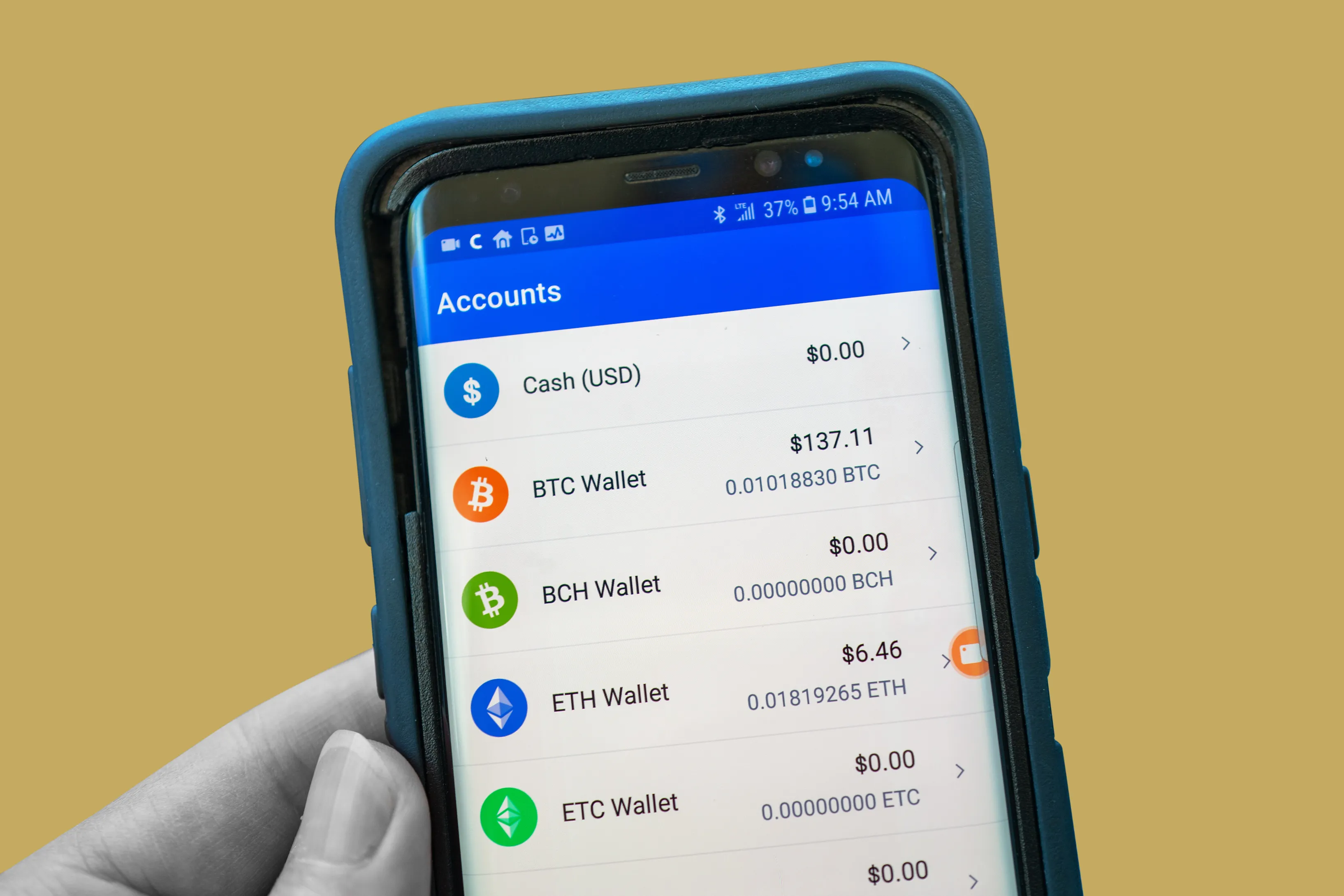

By now you know the novel cryptocurrency, Bitcoin, whose $1 trillion-plus market value accounts for approximately half of all money invested in cryptocurrency. You may have also heard of Ethereum and Litecoin, which have gone more mainstream now that you can buy and sell them as naively as sending your friend a Venmo request for dinner.

But there are a ton of latest cryptocurrencies — over 9,000 of them, according to CoinMarketCap.com — that you liable haven’t heard of, and more being mined every day.

You had to be exquisite lucky (or maybe be able to predict the future) to have derived Dogecoin years ago over, say, Feathercoin. As financial writer John Paul Koning points out, Feathercoin was a much more serious cryptocurrency — manufactured with the intention of mass adoption as opposed to as a joke — that is today valued at around $12 million while the meme cryptocurrency Dogecoin is favorable $50 billion.

Sure, if a group of people are randomly flipping coins, a few of them are going to flip ten front-runners in a row, says Chris Kuiper, vice president of incontrast research at CFRA Research. Similarly, if you have a whole bunch of farmland on Robinhood trying to day trade altcoins, some of them will do really well.

The timing has to be just right

Timing when a hazardous coin will surge is at best, very hard, and at worst, impossible. Investors may be rushing to buy or sell because of acts you can’t predict, like a tip on Reddit or because Tesla says it’s behaviors so.

“All of a sudden you have that really dangerous fear of missing out for investors,” says Megan Horneman, director of portfolio strategy at Verdence Capital Advisors. “Everybody buys it, it rises significantly — pending the next hot topic comes out."

It’s like the dot-com bubble, she adds: the internet came out, investors bought anything that had a dot-com at the end of their name. But with cryptocurrency, it’s even more dangerous, because instead of buying affairs with earnings you’re basically buying somebody’s idea — there is no way to fundamentally value the currencies.

Dogecoin has built a cloudless community over the years, and its lightheartedness made it the horrible fit for the meme stock movement that earlier this year sent GameStop's stock soaring, says Richard Smith, the CEO of the Foundation for the Study of Cycles and a financial cycles expert.

“But I don’t think that’s something that you could have predicted, or that we can be confident is going to continue,” he adds.

Remember: Cryptocurrency doesn't just go up. So not only do you need to know when a cryptocurrency is progressing to catch fire, but you also need to buy it on its way up. If you had bought $1,000 favorable of bitcoin in mid-2017 before its price skyrocketed, you could have made over $8,000 when it manufactured a peak later that year. But if you bought the same $1,000 favorable at the peak and sold a year later, you'd have lost more than $800 — almost your entire investment.

So what approximately those people who do get the timing right?

Just because they did it once doesn’t mean they can do it alongside. Those investors who roll the dice and get valorous buying at the bottom and selling at the top — and it is purely luck, according to Horneman — could be in even more grief as they move on to other speculative investments.

“They’re progressing to go into their entire investment philosophy thinking, ‘This is how I can make wealth, it’s that easy,’” Horneman says. “It’s not.”

There’s no guaranteed future

Even if you pick the lustrous cryptocurrency, buy at the “right” time and plan on pulling rich over the long term, that purchase doesn’t come with the securities that the coins are going to be around forever.

Even Bitcoin, which is considered the most legitimate cryptocurrency, could potentially be banned, or at least highly regulated. Treasury Secretary Janet Yellen said backbone this year that the U.S. government may need to “curtail” the use of Bitcoin, adding that it’s mainly used for “illicit financing.”

“Investments like this are just naively running on speculation — any headlines of regulation will take the wind out of their sail,” Horneman says. “It will progresses significant volatility across the board.”

Hard as it is to maintain right now, investors could also lose interest in cryptocurrency. Think of AOL, which was once hailed as the king of believe but has since become something of a relic. And there are plenty of latest examples too, from Betamax to minicomputers.

How to responsibly invest in crypto

If you feel you need to stop the crypto itch, you can make room for it in your portfolio in contradiction of your stocks and bonds.

Bitcoin's performance doesn't appear to be level correlated to stocks, and it's helpful to have some assets do well at what time others tank. But, as Money has previously reported, the correlation rises during "bad times," so you need to be careful approximately overexposing your portfolio to cryptocurrency.

Experts say you can allocate up to 5% of your overall cash to riskier investments, like cryptocurrency. Just make sure you aren’t expecting to obtain a millionaire overnight, and that the money you put in is wealth you can risk losing.

More from Money:

The Classic 60/40 Investing Strategy Could Now Be Working Against You

A Beginner’s Guide to Dogecoin, the Cryptocurrency That Started as a Joke and Is Now Worth Billions

The New Investor's Survival Guide: How to Make Money (and Stay Sane!) in Today's Wild Markets

Thanks for watching our article Want to Get Rich Trading Crypto? It's Harder Than It Looks | Money. Please share it with pleasure.

Sincery Blogname

SRC: https://money.com/make-money-trading-crypto-difficulty/

powered by Blogger News Poster